What Is The Eitc For 2025. The eic reduces the amount of taxes owed and may also. Filer benefits of around $2,500 (as of 2025) can.

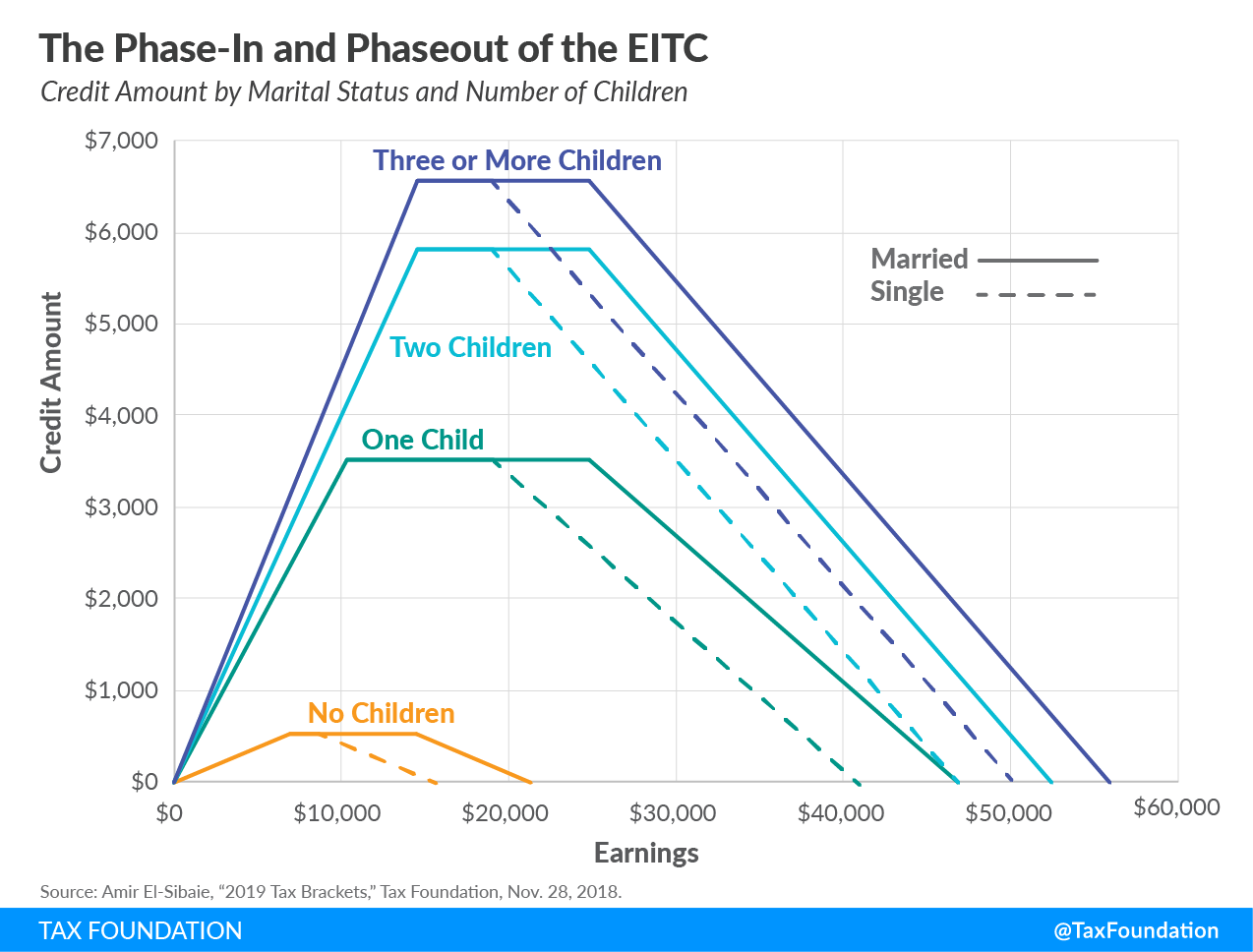

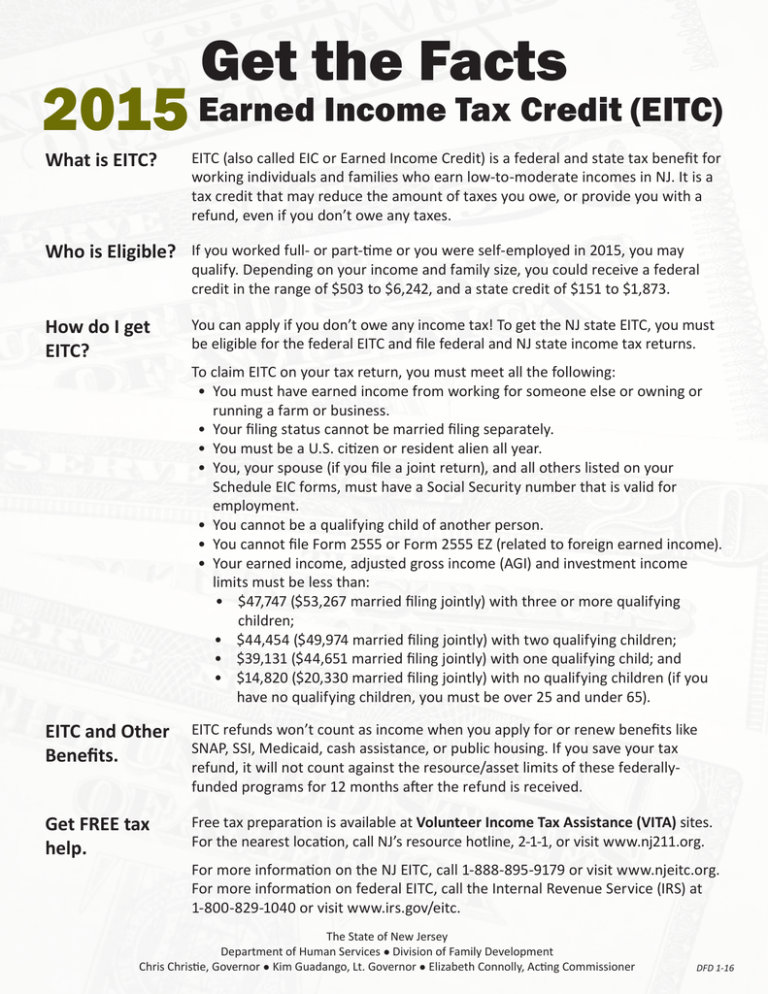

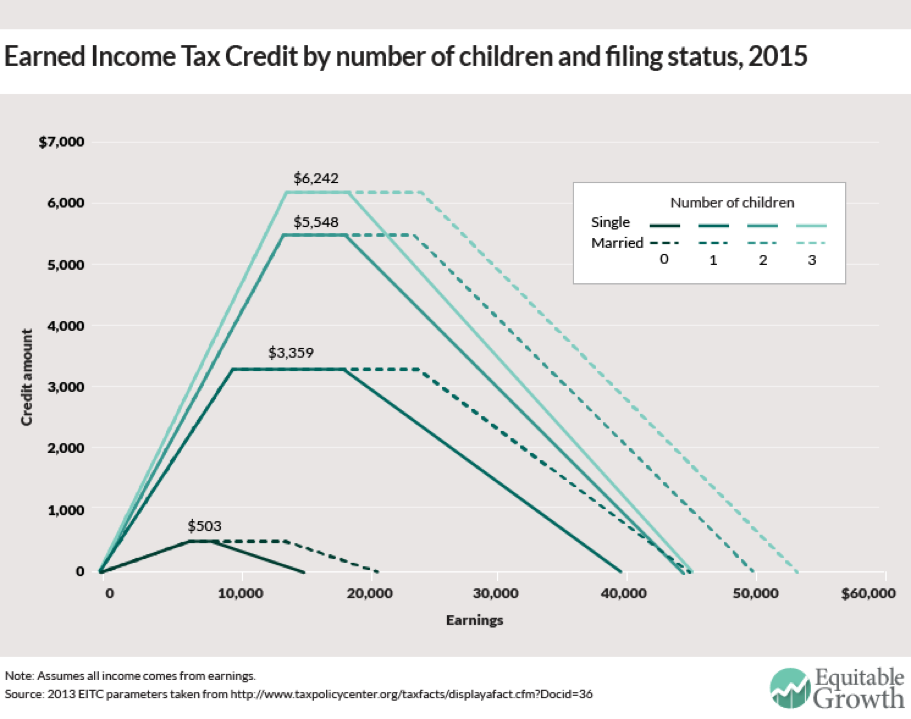

To claim the earned income tax credit (eitc), you must have what qualifies as earned income and meet certain adjusted gross income (agi) and credit limits for the current, previous and upcoming tax years. This section outlines the parameters for those who qualify for the earned income.

T160036 Senator Cruz's Tax Reform Plan with EITC Enhancement, by, Prepare accurate tax returns for people who claim certain tax credits, such as the: Anyone with earnings of $63,398 or less should see if they qualify at www.irs.gov/eitc or visit a.

T150154 Extend ATRA Earned Tax Credit (EITC) Provisions, by, Prepare accurate tax returns for people who claim certain tax credits, such as the: The earned income credit (eic) is a refundable tax credit available to working individuals with low to moderate incomes.

Treasury Audit Highlights the Need for Clearer Eligibility Guidelines, The earned income tax credit ( eitc) is a tax credit that may give you money back at tax time or lower the federal taxes you owe. Find if you qualify for the earned income tax credit (eitc) with or without qualifying children or relatives on your tax return.

What is EITC?, You have three years to file and claim a refund from the due date of your tax return. Income limits and amount of eitc for additional tax years.

What Is the Earned Tax Credit?, Use the eitc tables to look up. If you received more than $11,000 in investment income or income from rentals, royalties, or stock and other asset sales during 2025, you can't qualify for the.

how is eitc calculated The Conservative Nut, It’s a tax credit that ranges from $560 to $6,935 for the 2025. The earned income credit (eic) is a refundable tax credit available to working individuals with low to moderate incomes.

EITC, TANF and the Benefits Cliff Bacon's Rebellion, Anyone with earnings of $63,398 or less should see if they qualify at www.irs.gov/eitc or visit a. The earned income credit (eic) is a refundable tax credit available to working individuals with low to moderate incomes.

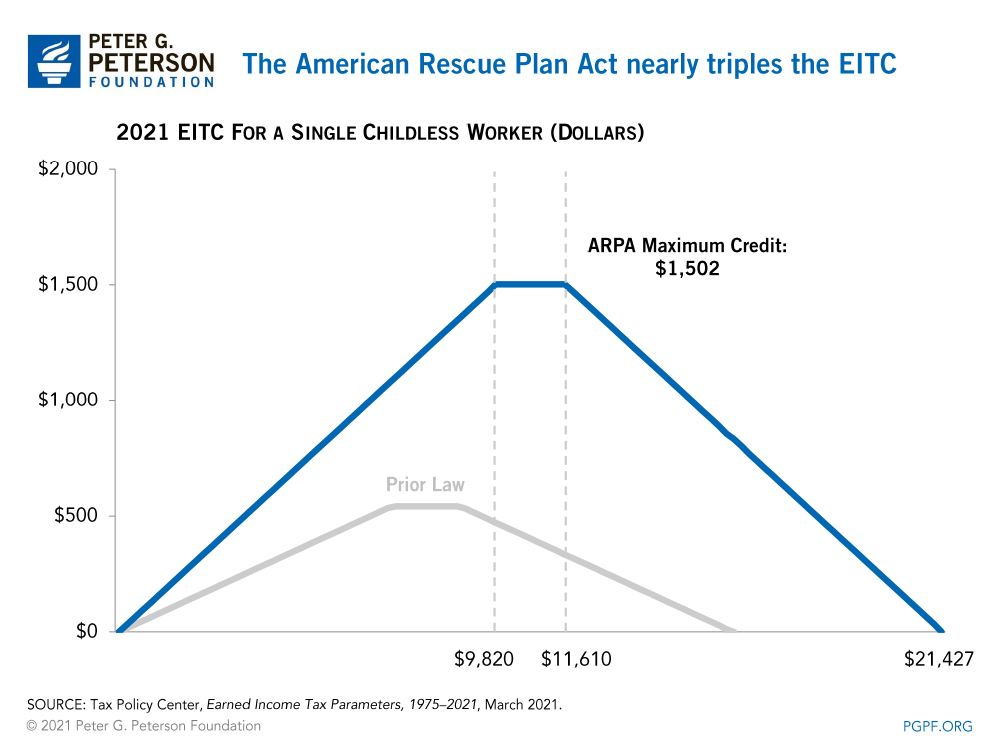

State EITC, Biden wants to expand the earned income tax credit, or eitc, a tax credit that is aimed at workers with incomes below about $64,000 annually. This credit is meant to supplement your earned income, which.

EITC Biggest Factor Boosting Single Mothers' Employment, Research Finds, Filer benefits of around $2,500 (as of 2025) can. This section outlines the parameters for those who qualify for the earned income.

State EITC Expansions Will Help Millions of Workers and Their Families, Biden wants to expand the earned income tax credit, or eitc, a tax credit that is aimed at workers with incomes below about $64,000 annually. You have three years to file and claim a refund from the due date of your tax return.