Maryland Inheritance Tax Exemption 2025. Iowa will completely phase out its inheritance tax in 2025. As of 2025, they were.

The maryland estate tax exemption is the threshold at which an estate becomes subject to state estate taxes.

More than 71 million beneficiaries receive social security and supplemental security income (ssi) benefits in the united states of america.

Estate and Inheritance Taxes Urban Institute, 723, 633 a.2d 93 (1993). Many people in maryland do not pay attention to estate tax, but 2025 may be the year that more families start taking notice.

Mw506r 2025 Fill out & sign online DocHub, Will not be impacted by federal estate taxes. What is maryland inheritance tax and who pays it?

Discover The Latest Federal Estate Tax Exemption Increase For 2025, Inheritance tax is a tax on the transfer of assets from a deceased person to their beneficiaries. 2025 estate and fiduciary forms.

Maryland form 502d Fill out & sign online DocHub, 2025 estate and fiduciary forms. 2025 estate and fiduciary forms.

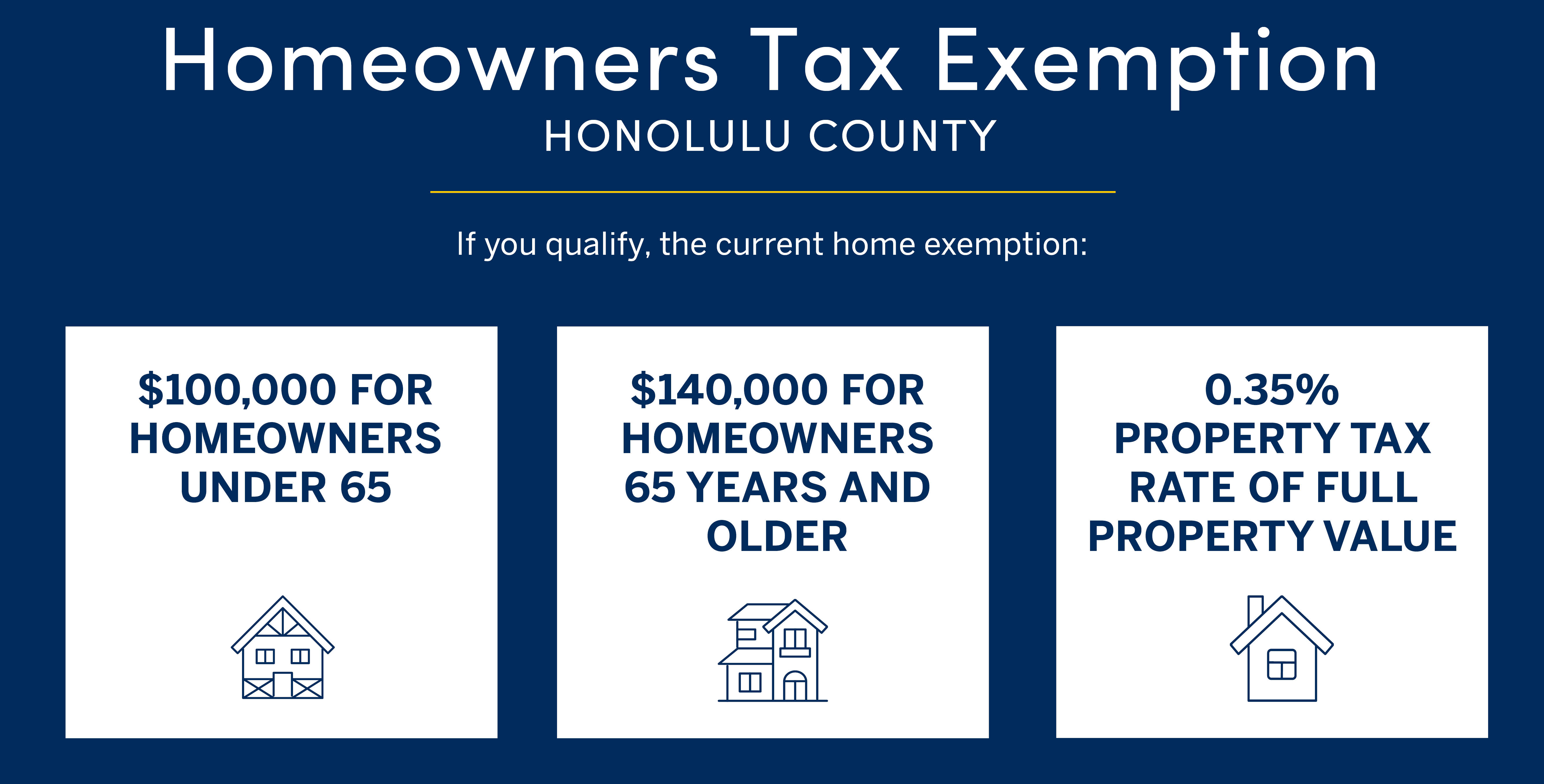

Understanding Property Tax in Oahu for 20232024, Last updated on january 14, 2025. There are potential changes on the.

Montgomery County Homestead Exemption 20192024 Form Fill Out and, Maryland is the only state with both inheritance and estate taxes. There are many exemptions to maryland's inheritance tax.

Nevada sales tax exemption form Fill out & sign online DocHub, Estate and inheritance tax information. The federal government’s estate tax exemption is $12.92 million in 2025.

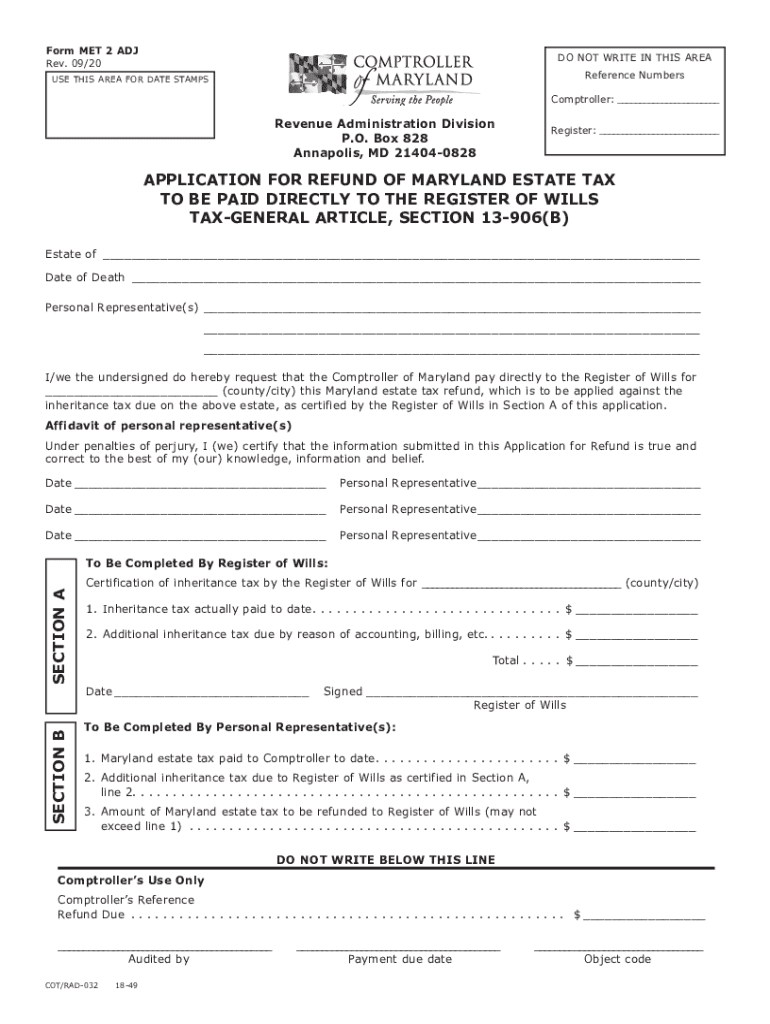

Md Met2adj Tax Online 20202023 Form Fill Out and Sign Printable PDF, Grave maintenance up to $500. 2025 estate and fiduciary forms.

Inheritance Tax Waiver Form Maryland For Domicile US Legal Forms, Life insurance benefits payable to a named beneficiary, other than the estate of the decedent. The maryland estate tax exemption is the threshold at which an estate becomes subject to state estate taxes.

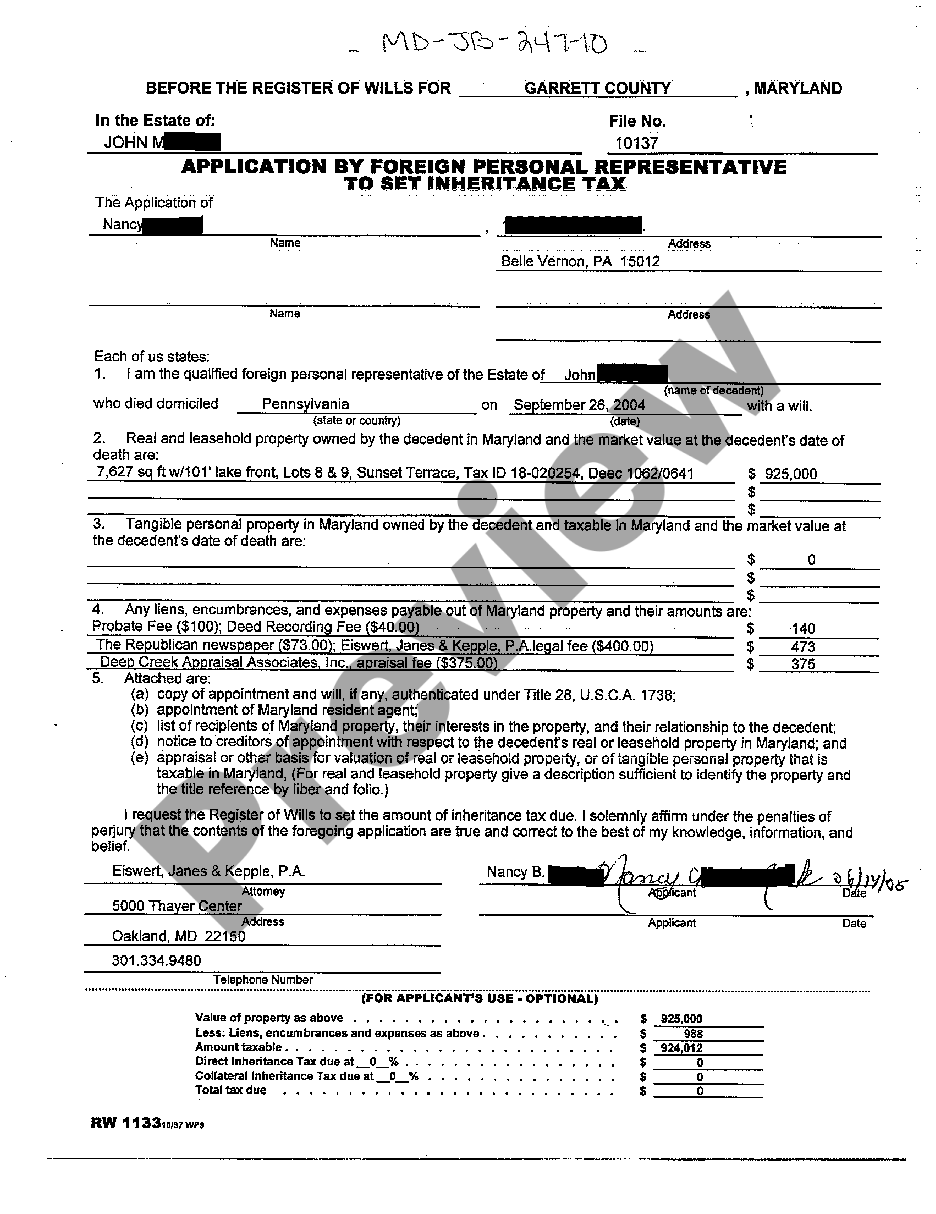

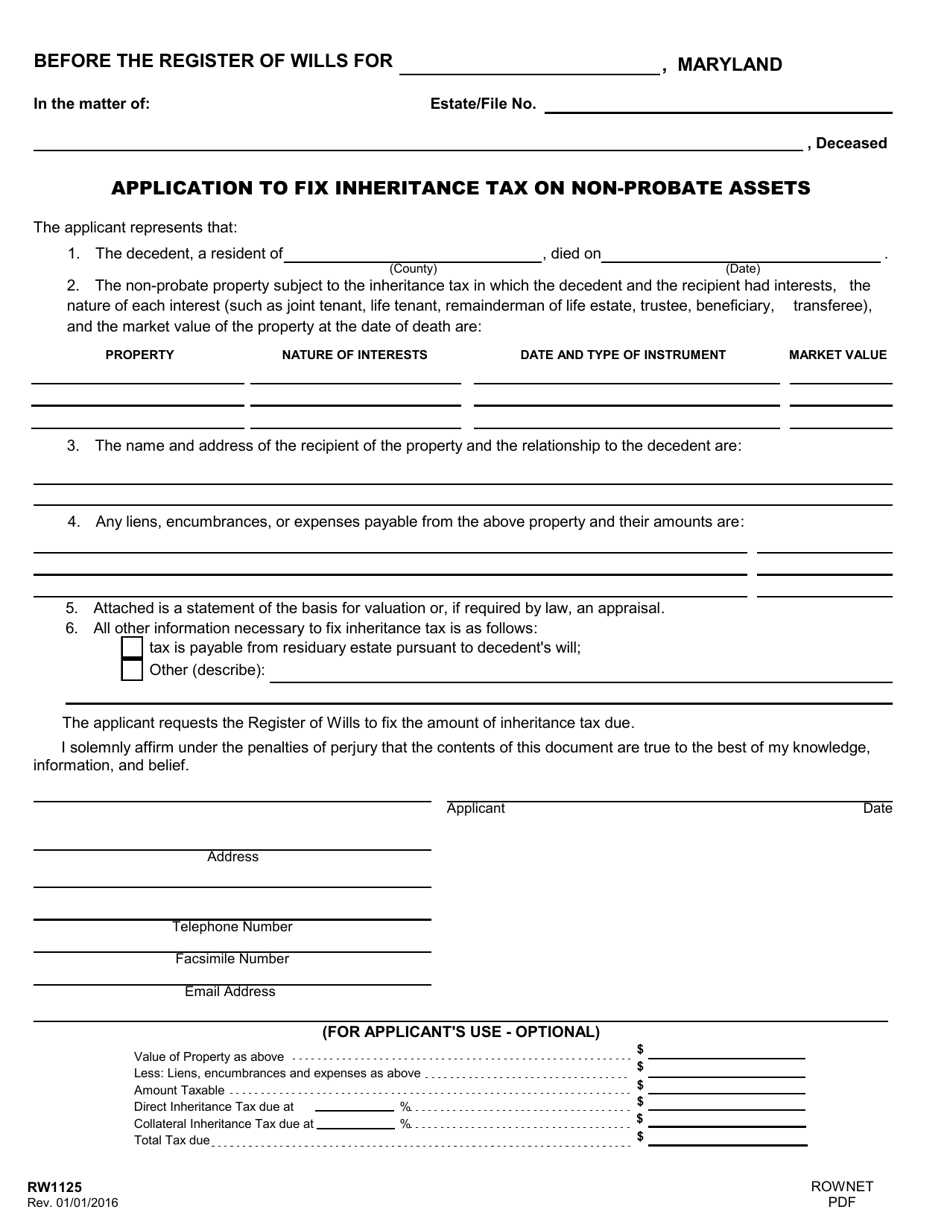

Form RW1125 Fill Out, Sign Online and Download Fillable PDF, Maryland, 723, 633 a.2d 93 (1993). Many people in maryland do not pay attention to estate tax, but 2025 may be the year that more families start taking notice.

The tax is levied on property that passes under a will, the intestate laws of succession, and property that passes.